capital gains tax news canada

Canadians pay a 50 tax on all of their. When you buy a home you must pay tax on its fair market value at the time of purchase.

Capital Gains Tax Break Becomes Part Of A Double Whammy When Home Prices Fall Don Pittis Cbc News

On March 11 Finance Canada released draft legislation on the Luxury Tax that was proposed in the 2021 Federal Budget.

. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. As of 2022 it stands at 50. This can be done using Section 1031 of the tax.

Congratulations now that you have earned a profit on your investment report it on your tax return because it is a taxable capital gain. But what some investors may initially neglect to take into account is. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Your sale price 3950- your ACB 13002650. The inclusion rate is the percentage of your gains that are subject to tax. But what some investors may not.

Since its more than your ACB you have a capital gain. The total amount you received when you sold the shares was 5000. Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date. In 2021 the net capital losses from 2018 can reduce the taxable capital gains to zero leaving 14000 of net capital losses.

The inclusion rate has varied over time see graph below. President Biden wants to raise the capital gains tax that wealthy people pay and use the extra revenue to fund new social spending on children and education. The listed personal property rules state that coins with a resale value.

1 day agoInvesting is all about making your money work for you - getting money without having to actually perform labor. Buy Bitcoin with AMEX. If you sell 1000 worth of ABC stock and 2000worth of XYZ stock in the same calendar year your net gain is 0 since the gains from.

The sale price minus your ACB is the capital gain that youll need to pay tax on. In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain. Investing is all about making your money work for you getting money without actually having to put in any work.

If you bought a cottage for 200000 and now sell it for 500000 you will receive. Net of the 5000 previously-claimed capital gains. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital.

Canadas capital gains tax was introduced in part to finance the growing costs of Canadas social security system and to create a more equitable system of taxation. Subject to parliamentary approval the tax will apply. On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. Balance out your capital losses.

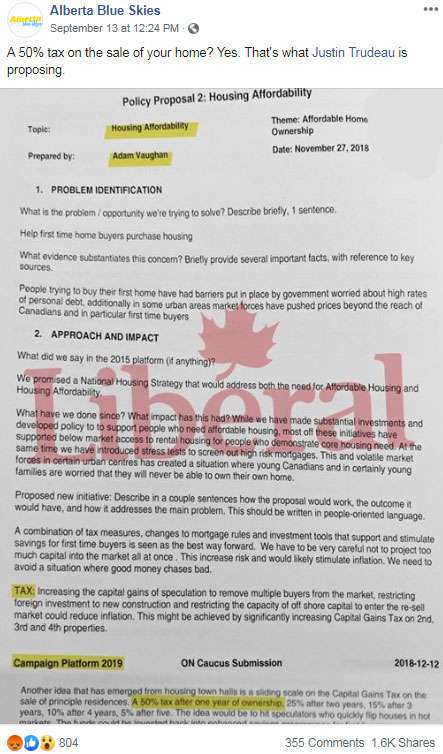

Fact Check Canada S Liberals Plan Capital Gains Tax On Home Sales

List Of Countries By Tax Rates Wikipedia

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Comparing Income Corporate Capital Gains Tax Rates 1916 2011 The Big Picture

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/7YDJFYY5XFCBHP2UCALOVAIIFY.jpg)

How To Prepare For A Potential Tax Hike On Capital Gains The Globe And Mail

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute

How Are Capital Gains Taxed Tax Policy Center

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

Foreign Capital Gains When Selling Us And Foreign Property

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Capital Gains Tax In Spain Do I Need To Pay It And How Much

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget